The Department of Defense is out with its latest report detailing the rise of Beijing's military. Here is what you need to know.

As Assistant Secretary of Defense for Indo-Pacific Security Affairs Randall G. Schriver emphasized in his rollout remarks on May 2, 2019, “our annual report to Congress, which we refer to as the China Military Power Report… is our authoritative statement on how we view developments in the Chinese military, as well as how that integrates with our overall strategy.”

Weighing in at a hefty 123 pages, this year’s document is nearly an inch thick. In terms of substance, it compares favorably among its seventeen predecessors. Among the report’s greatest strengths: as with previous iterations, it offers new data points and clarifications available nowhere else in authoritative form. This underscores the power of the U.S. government to disclose some of its collected information and accompanying analysis, a power this author and others believe should be used far more frequently.

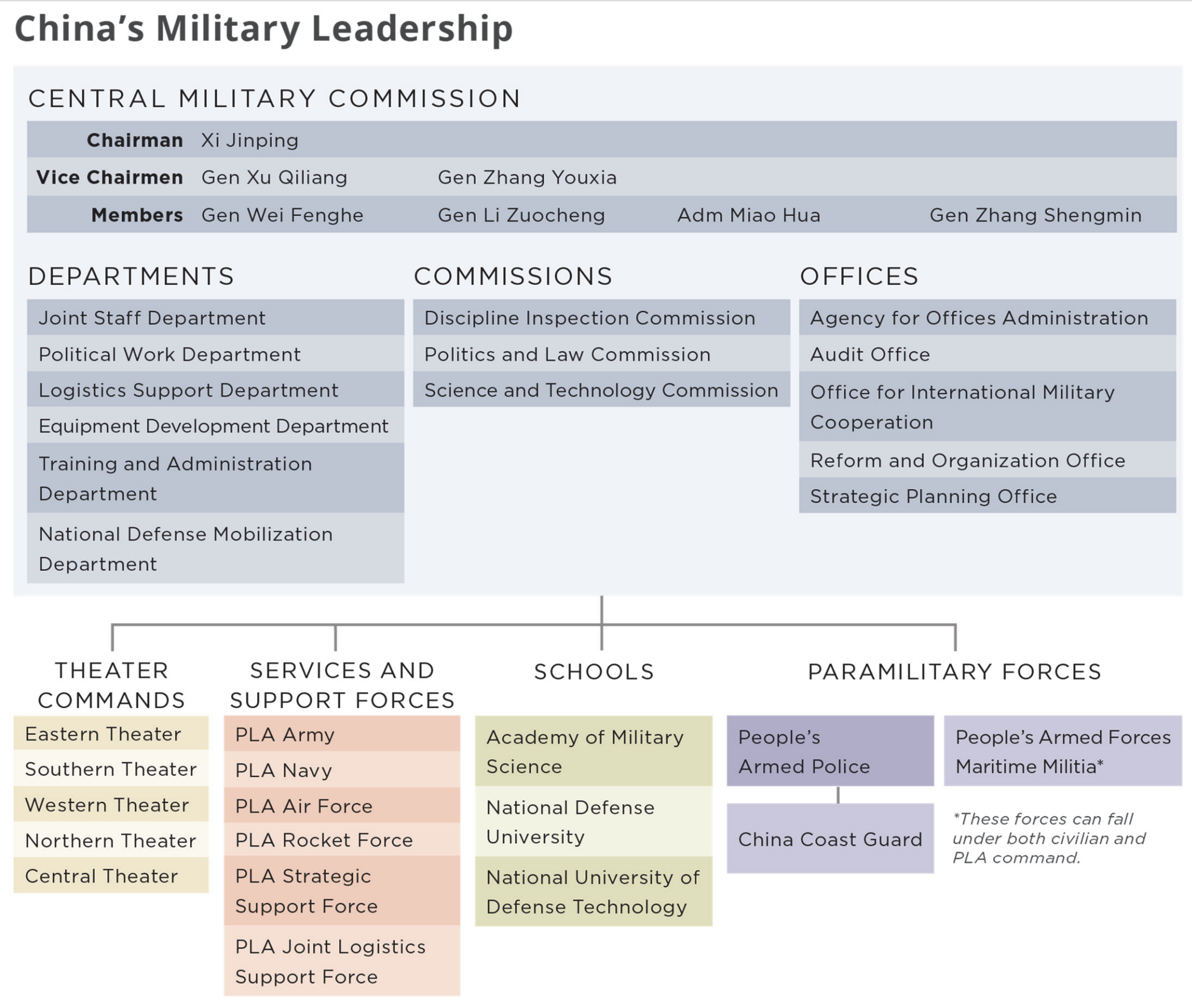

The report offers useful background throughout, with incremental updates. Pentagon releases are typically strong on concrete quantifiable details regarding force structure and technology, while rarely offering unique insights concerning abstract qualitative subjects such as the People’s Republic of China (PRC)’s strategic and doctrinal evolution. The history of this last topic, for instance, is covered well in such scholarly sources as M. Taylor Fravel’s new book Active Defense: China’s Military Strategy since 1949. Overall, however, the report rightly underscores that China under Xi Jinping is pursuing sweeping defense reforms as part of a comprehensive effort to make China a “strong country” with a “world-class military” by 2049. Xi himself has “called for more focused reforms of weapons procurement systems and other [civil-military integration] efforts to generate breakthroughs….” The Pentagon provides useful overviews of China’s Party-State-Armed Forces bureaucracy, including the current leadership of China’s obscure National Security Commission. The report’s delineation of China’s five Theater Commands and their respective assets and roles is particularly substantive and well-organized.

Special sections on PRC influence operations and Arctic efforts add useful focus, although they are concise to the point of being somewhat spare. “China in the Arctic” cites Danish concerns about Chinese “proposals to establish a research station in Greenland, establish a satellite ground station, renovate airports, and expand mining.” It also suggests possible future PLAN deployment of ballistic-missile submarines (SSBNs) to the Arctic Ocean. As Schriver emphasized, “whether or not that becomes an access point… safe harbor for strategic assets, such as ballistic-missile-carrying submarines, it is a possibility in the future and one we’ll watch very closely.”

In keeping with the Trump Administration’s outlook and priorities, there is greater emphasis on economic issues than in earlier years of the report. This year’s iteration highlights the U.S. Trade Representative’s conclusion that PRC government policies cause “harm to the U.S. economy of at least $50 billion per year.” Building on previous years’ analysis, the report judges that China’s defense budget grew an average of 8% inflation-adjusted from 2009-18. Beijing’s official military spending in 2018 was just over $170 billion; the Pentagon estimates actual spending at over $200 billion. As for revenue generation, China is currently in the top five of arms exporters globally, typically offering more flexible terms and creative side payments than competitors. Major deals with Pakistan and growing sales in the Middle East are bolstering order books. Armed UAVs are a major competitive advantage for China; most other would-be suppliers are bound by voluntary export control restrictions.

As an authoritative policy document, the report criticizes Beijing for its continued lack of transparency, including its failure to release a Defense White Paper since 2015. Notably, Schriver declared in his press briefing, “our concerns are significant when it comes to the ongoing repression in China. The Communist Party is using the security forces for mass imprisonment of Chinese Muslims in concentration camps.”

While the Pentagon chronicles many Chinese advances, it also acknowledges persistent weaknesses. As Schriver explains, “the report also suggests where they do need more work. …There are things that we do in terms of training, in terms of sophisticated integration of command and control… and intelligence, that they’re not quite there yet. The training is not as complex as ours.”

Maritime East Asia

This latest report continues a pattern of productive focus on the top-prioritized scenarios for People’s Liberation Army (PLA) preparation, including those concerning Taiwan and the South China Sea. It rightly points out that the PLA’s latest “military strategic guidelines” call for it to be prepared to fight and win “informatized local wars,” and to prevail in “maritime military struggle” that may span peacetime and wartime. It correctly concludes that “China expects significant elements of a modern conflict to occur at sea.”

The report devotes significant space to comparing PRC and Taiwan forces using a new methodology yielding substantially different numbers from previous years. It explains how rapid mainland military progress has rapidly eroded much the island’s technological and geographical advantages. For instance, China envisions and trains for a Joint Blockade Campaign designed to threaten Taiwan’s maritime and air access. Not only does it target Taiwan with a broad array of ballistic missiles, it even fields rocket artillery systems capable of spanning the Taiwan Strait, such as the PHL-03.

But the Pentagon is also frank about the PLA’s remaining limitations vis-à-vis its lead planning scenario. Seizure of small offshore islands is likely operationally feasible but would probably represent a Pyrrhic victory triggering international intervention far short of delivering control of the true prize: Taiwan proper, with its 23.5 million citizens and their free, democratic, Chinese-culture-infused society. While five Type 071 Yuzhao-class LPDs amphibious transport docks operational in the PLA Navy (PLAN) and three more are under construction/outfitting, the Pentagon judges that China has not launched enough amphibious warfare ships to optimally support relevant contingencies: “there is no indication that China is significantly expanding its landing ship force necessary for an amphibious assault on Taiwan.”

Regarding the South China Sea, the report draws linkages to key new pieces of hardware that may be particularly useful for that theater. These include the “world’s first large cargo UAV,” the AT-200, with 1.5 ton carrying capacity and ability to operate from “unimproved runways as short as 200 meters” including on small islands. Also relevant: the world’s largest seaplane, China’s AG-600. The report also underscores that China has deployed anti-ship cruise missiles (ASCMs) and surface-to-air missiles (SAMs) to the Spratlys in violation of Xi Jinping’s 2015 pledge not to militarize them.

Gray Zone:

The report pays proper attention to China’s emphasis on “gray zone” activities designed to fall below the threshold of armed conflict. Although the report also documents their use along China’s contested borders with India and Bhutan, such tactics are designed primarily to further disputed sovereignty claims regarding features and waters in the South and East China Seas (“Near Seas”). Here, China’s first sea force (the PLAN) often plays a backstop deterrence role over the horizon, while its second sea force (the China Coast Guard/CCG) and its third sea force (the People’s Armed Forces Maritime Militia/PAFMM) operate on the front lines. The CCG is “by far the largest coast guard force in the world.” It has “the ability to intimidate local, non-Chinese fishing boats, as occurred in an October 2016 incident near Scarborough Reef. The PAFMM is approximated only by Vietnam’s maritime militia, which is no match for it. On a related note, under the Joint Logistics Support Force, “The PLA is integrating civilian-controlled support equipment, including ships… into military operations and exercises.”

Since it first included coverage of the PAFMM in 2017, the Pentagon’s annual report has authoritatively showcased substantive details concerning this formerly under-considered force. This year, for the first time, the report includes both the CCG and PAFMM in an organizational chart depicting the leadership and chain of command of China’s armed forces. A dedicated section highlights increasing coordination and interoperability among China’s three sea forces, propelled by recent reforms including the CCG’s subordination to the People’s Armed Police (PAP), itself now under the sole command and control of the Central Military Commission. Notably, China’s three sea forces have shown greater interoperability amongst themselves than have the PAP and PLA between themselves.

Taken together, these developments could enhance the ability of China’s second and third sea forces “to provide support to PLA operations under the command of the joint theater commands.” In the South China Sea, the report stresses, “the PAFMM plays a major role in coercive activities to achieve China’s political goals without fighting….” It “has played significant roles in a number of military campaigns and coercive incidents over the years.” Of particular significance, “a large number of PAFMM vessels train with and assist the PLAN and CCG in tasks such as safeguarding maritime claims, surveillance and reconnaissance, fisheries protection, logistic support, and search and rescue.” Moreover, “In conflict, China may… employ CCG and PAFMM ships to support military operations.” This all makes it crystal clear that Chinese navy interlocutors cannot plausibly profess ignorance of the PAFMM to their foreign counterparts—as they have done repeatedly in official meetings. Based on the report’s nature and content, doing so profoundly insults American intelligence in all senses of the word.

In the South China Sea, “China has built a state-owned fishing fleet for at least part of its maritime militia force….” Hainan’s provincial government “ordered the building of 84 large militia fishing vessels with reinforced hulls and ammunition storage, which the [Sansha City Maritime Militia] received by the end of 2016, along with extensive subsidies to encourage frequent operations in the Spratly Islands.” Comprising China’s most professional PAFMM units, Sansha’s “forces are paid salaries independent of any clear commercial fishing responsibilities and recruited from recently separated veterans.” Meanwhile, China’s development and fortification of outposts on the South China Sea features it occupies allows China to “maintain a more flexible and persistent military and paramilitary presence in the area.”

In his Q&A with journalists, Schriver explained how the U.S. government’s understanding of China’s three sea forces affects U.S. policy in practice: “We’re less interested in the color of the hull than the activity and the actions. So what we’re most interested in is China behaving in a manner that’s respectful of international law and norms, and behaving in a manner that is not destabilizing and is more constructive. …if its coast guard and maritime militia or classic gray-hulled navy, if the design is to infringe upon the sovereignty of another country… with the objective of creating some sort of tension that results in a favorable outcome for them…. If they’re engaged in provocation or infringement on another country’s sovereignty, particularly our allies, then we would treat them differently than if they were doing what we would regard as more normal coast guard activities, or we don’t have necessarily the equivalent of a maritime militia, but peaceful activities.”

All these points emerged independently from extensive open-source research on the PAFMM that the author, Conor Kennedy, and colleagues conducted at the Naval War College’s China Maritime Studies Institute (CMSI) over the past five years. The Department of Defense has now validated our more specific findings and recommendations explicitly.

Naval Forces

Beyond the Near Seas, the PLAN, PLA Air Force (PLAAF), and other PLA services are charged with increasing power projection. This challenging task remains very much a work in progress. Each of China’s three sea forces is the world’s largest by the number of ships. Greater than the U.S. Navy in numbers although far behind it in tonnage at 1.8 million to 4.6 million, the PLAN is growing rapidly in force structure and related capabilities. Over the past decade, it has dispatched over 30 antipiracy task forces to the Gulf of Aden and beyond; the 29th escorted 40 ships over six months and provided medical assistance to two Chinese merchant ships.

The speed of growth for the PLAN’s already large submarine force has slowed, but remains impressive: the Pentagon’s revised projection still predicts 65-70 submarines by 2020. As for nuclear-powered variants, China has built six Shang-class attack submarines (SSNs) and four Jin-class SSBNs. In 2018, a Shang“sailed underwater in the vicinity of the Senkaku Islands.” While neither the report nor Schriver offered specifics regarding patrols, the report terms the four Jins already operational with JL-2 submarine-launched ballistic missiles (SLBMs) “China’s first credible, sea-based nuclear deterrent.” Using the 40+-year service life of China’s first-generation Han-class SSNs as a yardstick, the Pentagon forecasts that the PLAN will continue to operate Jin-class SSBNs even as it begins building next-generation Type 096 variants with JL-3 SLBMs the early 2020s.

Employing the world’s largest shipbuilding industry by tonnage, China is series-producing several major surface combatants. It has launched four 10,000-ton Type 055 Renhai-class cruisers, with several more under construction. Already capable of carrying various ASCMs and SAMs, “it will likely be able to launch ASBMs [anti-ship ballistic missiles] and LACMs [land-attack cruise missiles] once these weapons are available.” Chinese development of a sea-launched ASBM, presumably its third ASBM variant, is intriguing; the author knows of no previous reference in a public U.S. government report.

Nine Type 052D Luyang III-class destroyers are operational. Their vertical launch system can fire “cruise missiles, SAMs, and anti-submarine missiles.” 27+ Jiangkai II frigates are in service, with several more being built. Over 40 Jiangdao-class corvettes are operational, with more than a dozen under construction. Rounding out these surface fleet mainstays are 60 Type 022 Houbei-class missile catamarans.

China’s submarines and warships alike are outfitted with large quantities of potent cruise missiles, guided by increasingly precise over-the-horizon (OTH) data fusion and targeting capabilities. As the PLAN goes increasingly global in its deployments, LACMs will constitute a growing proportion of its weapons loadouts. This will offer new capabilities while exposing Beijing to unprecedented charges of gunboat diplomacy and aggression. While it brings enviable benefits unavailable to all but a select few, great sea power comes at a great financial and political cost.

This brings us to the PLAN’s largest and most avidly discussed vessels: aircraft carriers, which—operated effectively—are the apex predators of the seas. For many readers, one of the report’s most exciting revelations is that China began constructing its third aircraft carrier in 2018. This news was not confirmed conclusively by previous open sources, allowing the Pentagon to make a unique contribution with its disclosure. This second indigenously built carrier is poised to be China’s largest thus far, with the greatest endurance; and only one thus far with a catapult launch system capable of dispatching larger, more capable aircraft. It follows China’s first indigenously built carrier, slated for commissioning later this year. That platform, in turn, is based on China’s only operational carrier to date, the Ukrainian-built but Chinese-refitted Liaoning.

As the PLAN forms carrier groups, the Type 055 cruiser “will be China’s premier carrier escort for blue-water operations.” China is also operating new replenishment ships and is building “two new ships… specifically to support aircraft carrier operations.” Other PLAN vessels supporting power projection include large amphibious and logistical support ships and specialized blue-water auxiliaries “including high-capability intelligence collection ships (AGIs/AGOS).” Already, in 2018, the PLAN sent AGIs well beyond the First Island Chain. It dispatched a Type 815 Dongdiao-class AGI to continue a long-established pattern of spying on Rim of the Pacific (RIMPAC) exercises off Hawaii. Ironically, in May 2018 Washington disinvited the PLAN from RIMPAC “as a result of China’s continued militarization of disputed features in the South China Sea, violating a pledge by Chinese President Xi Jinping not to militarize the Spratly Islands.”

For all these advances, the PLAN “continues to lack a robust deep-water anti-submarine warfare capability.” But, in a widespread pattern of waterfront-wide work, China strives to improve in these and other areas, and is “installing undersea monitoring systems.” Already, China engages in behaviors that the Pentagon deems highly objectionable. These include applying a legal double standard to foreign military activities in such sea areas as the Exclusive Economic Zone; and escalating coercive tactics in contravention of rules, norms, and safety of seamanship, as seen in the PLAN destroyer Lanzhou’s unsafe encounter with the USS Decatur in September 2018.

Air Forces

China has the world’s third largest aviation forces, with more than 2,700 aircraft, of which more than 2,000 are combat aircraft. Among the latter, J-20 low-observable fighters “may have begun active service in small numbers, possibly with a testing and training unit.” Unmanned aerial vehicles (UAVs) are a particular area of Chinese focus and achievement. The Pentagon details a panoply of systems that have been respectively displayed, developed, and deployed. Aeroengines remain a critical Chinese weakness, but China is finally investing heavily in improvements. The 13th Five-Year Plan (2016-20) prioritizes turbofans as a top technology focus area, together with hypersonics and the deployment and hardening of satellites.

Like a 1950s Cadillac in today’s Havana, the H-6 bomber has been refitted exquisitely over time. The latest H-6K variant features improved engines and weapons, giving it range to strike Guam with a payload of six precision-guided CJ-20 air-launched cruise missiles (ALCMs). “Since at least 2016,” the report relates, “Chinese media have been referring to the H-6K as a dual nuclear-conventional bomber.” H-6K bombers could be escorted by Su-30 fighters. Refueling Su-30s with the PLAAF’s three Ukraine-purchased Il-78 tankers could extend their range beyond the First Island Chain.

As part of a larger effort to become a “strategic air force” capable of greater power projection, the PLAAF is also overseeing the development of at least one new bomber. The report predicts that this “H-20” bomber will have 8,500+-km range, 10+ metric tons payload, “and a capability to employ both conventional and nuclear weaponry.” To realize this in practice, China “is pursuing a viable nuclear ‘triad’ with the development of a nuclear-capable air-launched cruise missile” as well as a conventional ALCM. The report adds: “China may also be developing a refuelable bomber that could reach initial operating capability before the long-range bomber, which could expand long-range offensive bomber capability beyond the second island chain.”

The PLAAF controls one of the world’s largest advanced long-range surface-to-air missile (SAM) forces. Within it, China is test-firing the S-400 it purchased from Russia. It is also testing its own HQ-19 with reported ballistic missile defense (BMD) capability; one unit “may have begun preliminary operations.” Other SAMs in China’s inventory may have some BMD capability as well. SAMs, early warning radars, and fighter aircraft (the majority under PLAAF control)—as well as radars, jamming equipment, and anti-ship and anti-aircraft missile systems proliferating on Beijing’s South China Sea outposts—support a robust integrated air defense system already extending 300 nautical miles (556 km) from China’s shores.

Rocket Forces

A top-tier missile producer, China is the world’s most active ballistic missile developer and boasts some of the world’s leading nuclear and conventional systems. China’s nuclear forces include 90 ICBMs. A new variant under development, the multiple independently targetable reentry vehicle (MIRV)-capable, road-mobile DF-41, may also be rail-mobile and silo-based. Filling a void created by Moscow and Washington’s adherence from 1988 until recently to the Intermediate-Range Nuclear Forces (INF) Treaty, Beijing possesses the world’s largest land-based missile force. Schriver related: “I think [Admiral Harry Harris, former commander, U.S. Pacific Command] used to say 90 percent of [China’s ballistic and cruise missiles] would be non-INF-compliant if [China] were in fact in the INF.” This includes 150-450 medium-range ballistic missiles (MRBMs), 7,750-1,500 short-range ballistic missiles, and 270-540 ground-launched LACMs. Additionally, in the emerging area of hypersonic glide vehicles, China successfully tested a “hypersonic waverider vehicle,” the Xingkong-2, in August 2018.

China has deployed two major ASBMs, the DF-21D MRBM and DF-26 intermediate-range ballistic missile (IRBM). Both are supported by new OTH radars. The 1,500km+-range DF-21D can “attack ships, including aircraft carriers, in the western Pacific Ocean… and is claimed to be capable of rapidly reloading in the field.” The DF-26’s three variants, respectively, can conduct “conventional and nuclear precision strikes against ground targets as well as conventional strikes against naval targets in the western Pacific [as far away as the Second Island Chain] and Indian Oceans and the South China Sea.” China’s DF-26 inventory continues to grow.

Distant Areas

Given tremendous uncertainties confronting even Xi himself, the report is necessarily less clear regarding China’s constantly evolving security efforts abroad. It nevertheless offers some useful indications. Building on previous editions’ probing of Beijing’s energy security interests, it cites International Energy Agency projections that China’s percentage of oil imported will rise by 9% to reach 80% by 2035. Natural gas imports are forecast to rise just 2% to 46% over that seventeen year period. It also highlights a growing doctrinal focus on “forward edge defense,” and the PLAN’s engagement in an “OBOR [Belt and Road Initiative/BRI-focused] cruise” in mid-2017. It advances the noncontroversial proposition that “China’s advancement of global economic projects will probably drive new PLA overseas basing through a perceived need to provide security for OBOR projects.”

The report further suggests that BRI-related port investments and access could enable China “to pre-position the necessary logistics support to sustain naval deployments in waters as distant as the Indian Ocean, Mediterranean Sea, and Atlantic Ocean to protect its growing interests.” In an allusion that echoes typical Chinese telegraphing of possibilities by citing foreign sources, the report states, “International press reporting in 2018 indicated that China sought to expand its military basing and access in the Middle East, Southeast Asia, and the western Pacific.” This statement was significant enough for Schriver to repeat it in his oral overview. Meanwhile, Beijing is collecting intelligence through military attaches in more than 110 offices worldwide, in addition to the manifold cyber means mentioned throughout the report.

Where the report becomes more substantive and specific is in its survey of China’s first overseas base in Djibouti and what sort of basing approaches Beijing may pursue moving forward. It posits that “a mixture of military logistics models, including preferred access to overseas commercial ports and a limited number of exclusive PLA logistics facilities, probably collocated with commercial ports, most closely aligns with China’s overseas military logistics needs.”

Djibouti is a new operating area for the rapidly expanding PLAN Marine Corps. It is the first location in which the PLAN MC has been seen to deploy wheeled armored vehicles. The fifteen such combat vehicles are garaged in a massive walled complex that contains substantial underground facilities. Overall, the PLAN MC has major plans but remains a work in progress in organization, training, and equipment. To achieve requisite air assault capability, for instance, the Pentagon projects that the PLAN MC will “likely need a minimum of 120 attack and medium-lift helicopters.”

Space

The level of coverage this year’s report devotes to Chinese space and counter-space development represents a major advance over previous years when the Pentagon sometimes seemed to shy away from the subject in public. Clearly renewed focus is warranted: 2018 was Beijing’s most prolific space launch year yet, with 38 of 39 space launch vehicles lofted successfully and roughly 100 spacecraft orbited. The fact that “China is working to develop a space-based early warning capability” could enable a “launch on warning” nuclear posture, raising important questions for the Sino-American deterrence relationship. To address this robust new content, the author obtained permission from noted space capabilities and law expert Michael J. Listner to share his observations on the subject:

The report emphasizes space as one of the eight strategic tasks or missions China must be ready to execute and gives robust attention to this strategic task—the most comprehensive treatment yet—which underlines the importance the Pentagon and the PLA both place on the space domain. This continues a trend of more public disclosure to highlight space security challenges, which also includes a report on threats to space security by the Defense Intelligence Agency. The PLA’s emphasis on this strategic task underlies its understanding of the importance of space control, or a nation’s ability to ensure its own access to outer space and to deny access to a geopolitical adversary, which it identifies as “information dominance.” The PLA intends to implement its information dominance strategy through organization and capabilities to ensure space access to the PLA and deny it to an adversary in any conflict.

A prominent discussion in the report is how the PLA is dynamically altering the organizational structure of its space forces to achieve information dominance. Following China’s 2015 Defense White Paper, which identified space as a commanding height, the PLA began in 2016 to reorganize its space operations under the Strategic Support Force (SSF). The Pentagon’s 2018 report glossed over the SSF but the current report goes into much greater depth, outlining the structure of the PLA to include reorganization of departments and activities in 2018 to bring the SSF to operational status. The report makes clear that the SSF is intended to resolve bureaucratic power struggles that have plagued PLA space operations and streamline not only operations but acquisitions. This has a familiar ring as the proposed U.S. Space Force and reorganizations for acquisitions seeks a similar outcome.

The report categorizes capabilities into two groups: space and counter-space capabilities, which appears to designate separate capabilities for military and civilian use. While some capabilities and plans may not play into information dominance, the PLA is still a player and in many cases has a dominant role. It is also worth noting that China’s space program and capabilities not only play into future plans, including the BRI, but also further China’s geopolitical interests through cooperation agreements and national prestige. They serve as a means of wielding soft power and gaining influence in less-developed nations and international bodies alike.

The report outlines space capabilities, including ground infrastructure and data relay and tracking stations, with emphasis on the Neuquén Deep Space Facility in Argentina. It also focuses on moon-related successes and ambitions for both exploration and exploitation, including a lunar base. One interesting item is commercial space activities to develop launch capabilities in China. The report stresses that these companies are state-backed ventures, as opposed to the paradigm of U.S. commercial space companies. The goal of these state-backed companies is to increase innovation and bring capabilities to fruition sooner than would strictly government efforts. While the report has identified some success, it still uncertain whether commercial ventures will pan out in the long term should state bureaucracy choose to assert itself if it perceives the commercial sector as a rival to government-owned industry. Conspicuously missing (aside from a brief mention) is China’s space station, which will begin assembly in 2020. Aside from being a symbol of national prestige and technical prowess, China is using it to exert and extend its soft power in the UN, and particularly the UN Office of Outer Space Affairs, which has an agreement with and receives funding from the Chinese National Space Agency (CNSA) to promote partnerships with nations and non-governmental entities to utilize the facility upon completion.

Counter-space capabilities continues to be the focal point of the PLA’s information dominance strategy. The report notes the PLA is acquiring and testing technologies that could have dual-use as counter-space activities. Hard-kill anti-satellite (ASAT) weapons similar to the instrument used in the 2007 testgarner the most attention but the report notes the PLA is developing other technologies that employ soft-kill to or cripple or otherwise sideline space assets. The report remarks no official comments on what ASAT technology China has developed, deployed, or demonstrated since its dramatic 2007 test. Schriver likewise studiously avoided this topic during Q&A with the media. Despite the lack of official comment, the applicability of the technology being developed, combined with Chinese writings, suggests space assets as specific targets at the opening stages of a conflict and targets of opportunity during the conflict. This is consistent with pursuit of information dominance.

A Useful Contribution

Authoritative in nature, ambitious in scope, and controversial in context, a report of this sort inevitably attracts criticism. Chinese state media mouthpieces and spokespeople denounce the report annually, typically without offering any substance of their own. The report represents a bureaucratically assembled patchwork of information whose stitching is not always perfect. A single public deliverable from a busy bureaucracy drowning in more urgent takings—many highly classified and unknown to outsider observers for years—it is never intended as a model of expository writing for its own sake. But this year’s report offers both stronger takeaways and less confusion and arguable inconsistency than usual.

Certainly, there are always points that people quibble over. This author, for instance, disagrees with the report’s use of the phrase “China’s ‘near seas’” to describe the Yellow, East, and South China Seas—the vast majority of which are part of the global maritime commons and should remain so. On a far more substantive note, Harvard doctoral student Elsa Kania has suggested how the report might consider some key Chinese terminology with greater context and nuance. She nevertheless welcomes this year’s report’s “more detailed discussion of emerging technologies, including robotics and artificial intelligence, advanced computing, quantum technology, and hypersonic and directed-energy weapons.” In encapsulating the greatest areas of Chinese advancement for reporters at the rollout event, Schriver acknowledged the importance of such technologies: “their power projection through ballistic and cruise missiles is an area they’ve made tremendous progress and they continue to develop enhanced capabilities in those areas. …particularly in new domains, they’ve invested a lot in cyber, space, hypersonics, A.I.”

What everyone can surely agree on: with China’s continued comprehensive efforts there will be no shortage of issues for the Pentagon to cover in next year’s report. However imperfect such coverage, we are far better off with it than without it.